Key Takeaways

- Corporate cards give organizations real-time expense tracking, reducing the time spent on manual reconciliation.

- Customizable spending controls are crucial for maintaining budget discipline and preventing unauthorized expenditures.

- Virtual and single-use cards answer security and flexibility concerns in an increasingly digital workforce.

- Integration with digital wallets and APIs simplifies financial operations and supports modern reporting needs.

Corporate cards are becoming central to strategic financial management, going far beyond their original role as simple payment solutions. Today’s businesses increasingly rely on these cards to drive efficiency, foster accountability, and maintain tighter controls over day-to-day spending. Modern startup credit cards are at the forefront of this transformation, delivering advanced features that enable real-time oversight, seamless integration, and enhanced security for organizations of all sizes.

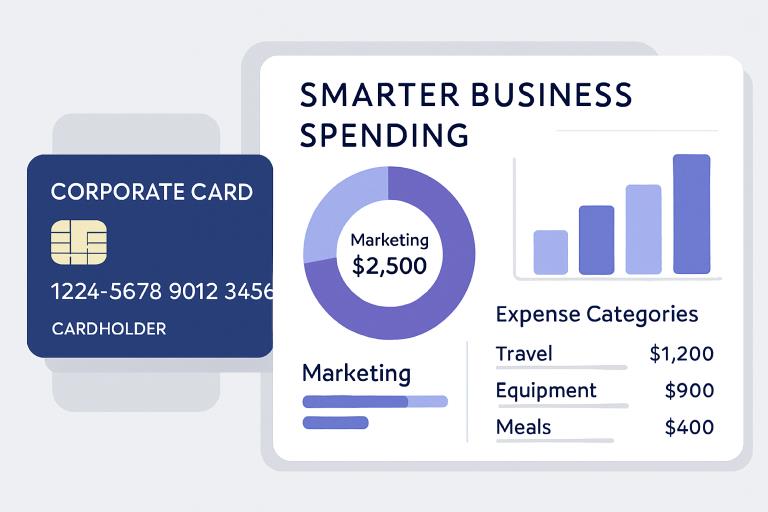

The shift to smarter business spending is fueled by technology that enables organizations to monitor, categorize, and control outflows in real time. Now, corporate cards are helping teams eliminate manual processes, make rapid purchasing decisions, and adjust financial policies with unprecedented precision. With customizable controls and instant digital issuance, these cards have reshaped how companies manage money.

From frontline employees swiping cards on business trips to finance executives automating reconciliations, organizations benefit from innovations that reduce errors and boost compliance. Adopting these modern tools gives businesses, especially startups and SMEs, a clear competitive edge in a rapidly changing financial landscape.

As the demands of commerce evolve, digital payment tools like corporate cards have set new standards for agility, oversight, and convenience. Companies that leverage these tools are better positioned to keep pace with market changes and uphold policy adherence.

Real-Time Expense Tracking and Automated Reporting

One of the defining features of today’s corporate cards is the ability to track spending as it happens. Transactions are updated on dashboards in seconds, allowing organizations to gain immediate insight into cash flow. This level of transparency eliminates ambiguity and reduces time spent chasing down receipts or clarifying outlier transactions. Automated expense reporting further enhances the process by populating financial systems with categorized data, minimizing manual entry and the likelihood of errors. According to McKinsey & Company, these digital innovations have had a measurable effect on cost control and policy compliance for enterprises large and small.

Customizable Spending Controls

Corporate cards now give finance leaders the ability to set detailed parameters on spending activity. Customizable controls may be applied based on transaction amount, merchant category, day and time, or even geographical location. This provides employees with trusted autonomy while enabling companies to stop unauthorized transactions before they occur. For teams managing multiple cost centers, granular controls mean budget limits can be assigned by department or project, reducing the chance of overspending and eliminating the need for after-the-fact corrections. As pointed out in PR Newswire, this approach not only boosts organizational efficiency but also strengthens internal controls without hindering employee productivity.

Virtual and Single-Use Cards

Businesses are increasingly turning to digital-first solutions that prioritize security and flexibility. Virtual and single-use corporate cards fit this need perfectly. These cards can be generated instantly, configured for one-off or ongoing purposes, and set to expire after completion of specific transactions. Virtual cards make it easy for companies to extend secure payment privileges to remote workers, vendors, or temporary contractors, all while maintaining control over limits and validity. In a landscape marked by rising cyber fraud threats, single-use cards offer peace of mind by eliminating the risk of lost or stolen plastic cards while ensuring every dollar spent is accounted for in real time. This method streamlines reconciliation and supports decentralized workforces as traditional office boundaries become less relevant.

Integration with Digital Wallets and APIs

The growing adoption of contactless payment has made integration with digital wallets an essential requirement for corporate card programs. Synchronization with services like Apple Pay and Google Pay enables employees to pay efficiently at physical or online checkouts, supporting quick commerce without any security tradeoffs. Beyond mobile payment support, modern financial platforms offer robust APIs that allow seamless synchronization with core accounting, ERP, and expense management systems. Automating data flow minimizes manual intervention, helps businesses maintain up-to-date ledgers, and shortens reporting cycles. This interconnectedness also allows organizations to produce accurate, timely financial statements and adapt easily to new compliance requirements.

Enhancing SME Liquidity

Access to timely credit is often a challenge for small and medium-sized enterprises. Corporate credit cards offer a lifeline by providing fast, flexible purchasing power tailored to immediate needs. Unlike traditional loans, which depend on slow approval processes, cards can quickly bridge cash flow gaps, supporting operational continuity in the face of delayed receivables or seasonal fluctuations. Card programs incorporate real-time monitoring tools, limit settings, and automated categorization features, improving financial discipline while allowing SMEs the agility to respond to sudden challenges or opportunities. Industry insights from Business Wire highlight how credit cards are supporting healthier liquidity management within growth-oriented businesses.

Conclusion

Corporate cards have moved far beyond their origins as payment facilitators and have become pivotal to smarter and safer business spending. By embracing real-time expense tracking, granular controls, digital issuance, and seamless integrations, businesses are better able to forecast, adapt, and enforce policies in a dynamic marketplace. The evolution of corporate cards places empowered, responsible spending at every employee’s fingertips, setting a new standard for financial management in the modern workplace.