One of the most significant aspects of running a business in Malaysia is the management of invoices. All sales, services, and payments should be entered properly to keep the financial clarity and satisfy the tax demands.

However, most companies continue to use manual types of invoicing systems, which are slow, prone to error, and not easy to monitor. This causes payment delays, compliance risks, and unwarranted administrative pressure.

Nevertheless, electronic invoicing is now becoming the new standard as Malaysia transitions to structured digital tax reporting.

Under LHDN guidelines, businesses are expected to issue invoices that are valid, trackable, and stored electronically.

Therefore, it is important to know how this system functions in order to remain in compliance and do things efficiently.

This guide will take you through what e-invoicing is, how it works, and how it can benefit your business in very easy and clear steps to ensure you can easily and confidently go through the transition.

Understand What E-Invoicing Is and Why It Matters

Before deciding on the ideal system to use, it’s essential to first know what e-invoicing is before deciding on which system to use.

The e-invoice software Malaysia can enable businesses to produce e-invoices in electronic formats that are electronically verified by the tax authority. Such invoices are not simply PDFs; they are records based on the data that can be checked and traced.

What an e-invoice does:

- Converts invoice data into a structured digital format

- Sends the invoice for real-time validation

- Generates a unique invoice ID and QR code

- Stores records securely for audits and reporting

This process replaces paper, reduces errors, and ensures your business follows national tax regulations.

Learn How the E-Invoice Process Works

E-invoicing follows a clear workflow that ensures accuracy and compliance.

- You create an invoice in your system.

- The data is converted into a structured format.

- The invoice is submitted for validation.

- Once approved, it is assigned a unique reference.

- The customer receives the verified invoice.

This real-time validation ensures your invoice is compliant before it is issued, reducing rejections and disputes.

Key Benefits of Using E-Invoice Software in Malaysia

E-invoice software is not just a replacement for paper invoices. It changes the financial, compliance, and customer payment management of your business. The fundamental advantages that Malaysian companies enjoy upon implementing an electronic invoicing system are listed below.

- Higher Accuracy and Fewer Errors

Manual invoicing is subject to errors like wrong totals, no tax details, and duplication of records. The e-invoice systems validate the information automatically, and all the necessary fields are properly filled, and the calculations are made correctly. This saves on rework, rejected invoices, and also keeps your records clean and reliable.

- Lower Costs and Faster Operations

The conventional method of invoicing requires printing, scanning, filing, and postage, which is time and money-consuming. E-invoicing will automate the whole process, from creation to storage.

Businesses can significantly reduce:

- Printing and stationery expenses

- Physical storage costs

- Administrative labour

- Delays caused by manual processing

The result is a faster, leaner invoicing process that saves both time and resources.

- Stronger Tax Compliance in Malaysia

The tax authority of Malaysia demands the use of well-structured digital formats of invoices to be validated. The e-invoice software automatically checks all the regulatory requirements in your documents.

It:

- Applies correct tax rules

- Includes mandatory data fields

- Creates a digital audit trail

This makes compliance easier and protects your business from penalties or rejected submissions.

- Faster Payments and Improved Cash Flow

E-invoices are received immediately and monitored on time. You are able to know when a customer receives, checks, and pays an invoice.

This saves on follow-ups, cuts short payment cycles, and gets your business its cash flow, which makes it easier to manage its expenses and plan with confidence.

- Stronger Data Security and Fraud Protection

Paper invoices may become lost, damaged, or fall into the wrong hands. E-invoice systems are encrypted, access-controlled, and digitally verified.

Every invoice is given a special identifier, and thus, it is authentic, and your business is not affected by fraud or manipulation.

How to Choose the Right E-Invoice Software?

The process of selecting the appropriate e-invoice system begins by making sure that it complies with the Malaysian regulatory standards.

The software is expected to meet the requirements of LHDN entirely and be able to handle structured invoice formats that can be electronically validated.

Real-time validation is required as well because it helps to check invoices prior to submitting them and eliminates the chances of rejection.

Another significant consideration is integration with available accounting tools, since it enables data to move between systems automatically without having to enter it manually.

Cloud storage is secure, and your financial records are easily accessible anytime you need them.

Also, when you need help, the local customer support is trusted to help you out fast and to keep your business running smoothly.

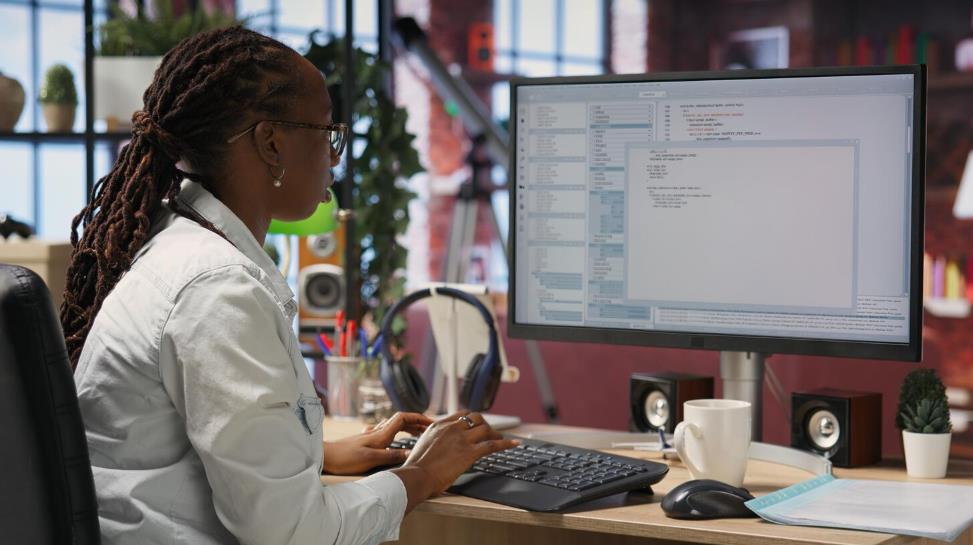

How to Prepare Your Business for E-Invoicing?

To make the transition smooth, preparation is important. Begin by tabulating your records of customers and suppliers in such a manner that every detail is full and precise.

The current standards of regulations should also be reflected in your tax codes and invoice templates.

Employees are supposed to be educated on how to prepare, invoice, and track e-invoices to enable them to feel comfortable with the new system.

In addition, to prevent completely switching over, it is better to test the process using a few sample invoices and then identify and resolve any issues early enough without disrupting your daily business.

Final Thoughts

Malaysian businesses no longer have the option of not using e-invoicing. It makes compliance easier, enhances efficiency, and increases financial accuracy.

The early adoption of the appropriate system helps businesses to operate better, minimize expenses, and remain in line with the national regulations.